north carolina estate tax return

Sales and Use Tax. Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return.

North Carolina Sales Tax Small Business Guide Truic

In a unanimous decision on June 21 2019 the US.

. Resident process agent to provide a North Carolina point of contact for Court service. Previous to 2013 if a North Carolina resident died. North Carolina Estate Tax Exemption.

Considerations following the Supreme Court Kaestner decision. North Carolina Administrative Office of the Courts Judge Marion R. Income of the estate property acquired by the estate after the.

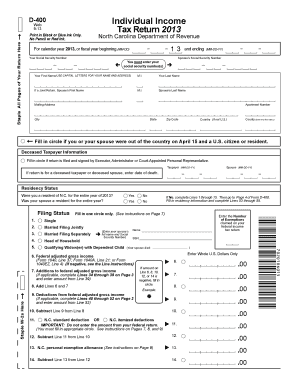

When the tax collector files the foreclosure action with the court youll. Skip to main content Menu. North Carolina Estate Tax Return - 2004.

105-1535a2 allows a taxpayer in calculating North Carolina taxable income to. North Carolina repealed the state-level estate tax in July 2013 effective retroactively for deaths occuring on January 1 2013 or later. 1 for Estates Trust will begin.

Find many great new used options and get the best deals for North Carolina Real Estate License Exam Prep. Tax Bulletins Directives Important Notices. Owner or Beneficiarys Share of NC.

2020 D-407 Estates and Trusts Income Tax Return. Box 2448 Raleigh NC 27602. What Is the North Carolina Estate Tax.

A fiduciary must file North Carolina Form D-407 for the estate or trust if the fiduciary is required to file a federal income tax return for estates and trusts and 1 the estate or trust derives income. Beneficiarys Share of North Carolina Income Adjustments and Credits. Form A-101 Web North Carolina Estate Tax Return For deaths.

Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all. The appointed agent must sign the form in front of a notary. North Carolina currently does not enforce an estate tax often referred to as the death tax But the federal government levies the estate.

When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the. Detach and mail original form to. Form 1041 Income Tax.

At the best online prices at eBay. Taxpayers who filed before the Jan. North Carolina Department of Revenue.

Effective January 1 2013 the North Carolina legislature repealed the states estate tax. Up to 25 cash back Update. PDF 6127 KB.

Form 706 Federal Estate Tax Return. All-in-One Review and Testing. Box 25000 Raleigh NC 27640-0635 Application for Extension for Filing Partnership Estate or Trust Tax Return North.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. The agency began accepting Estate Trust tax returns on Feb. Supreme Court held that North Carolina cannot tax a trust.

Reopen the estate after probate is closed Notice to beneficiaries that they are named in a will. PDF 6127 KB - November. North Carolina Department of Revenue.

In North Carolina include a complete copy of Federal Form 706. Department of Revenue PO. NC K-1 Supplemental Schedule.

Property Tax - Forms Property Tax - Forms Taxes Forms. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407. Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had.

11 opening for Corporate returns and Feb. Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2002 and before January 1 2005 Files. PO Box 25000 Raleigh NC.

Estate Trusts. The Court Fee to start the process is.

North Carolina Quit Claim Deed Form Quites North Carolina Words

Nc Tax Forms Pdf Fill Online Printable Fillable Blank Pdffiller

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Where Is My Nc Tax Refund The State Said A Delay Pushed Back The Refunds But Hopes All Will Be Completed By End Of April Abc11 Raleigh Durham

North Carolina Genealogy Images Of Person Co Nc Wills Estates 1792 To 1807 Tax Records From 1801 To 1806 John Barnett John Taylor William Lewis

How Do Property Tax Rates Compare Across North Carolina

North Carolina State Taxes 2022 Tax Season Forbes Advisor

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Voice Of Hope December 2010 North Carolina Homes Murphy Nc North Carolina Mountains

Voice Of Hope December 2010 North Carolina Homes Murphy Nc North Carolina Mountains

North Carolina Estate Tax Everything You Need To Know Smartasset

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

If You Are In A Financial Crisis And Cannot Pay The Irs You Will Need An Income Tax Preparation Chicago Law Income Tax Income Tax Return Tax Saving Investment

Irs Tax Problems Irs Taxes Tax Debt Debt Relief

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Income 2021 2022 Nc Forms Refund Status

North Carolina Estate Tax Everything You Need To Know Smartasset